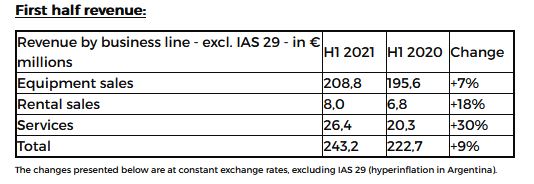

In a global aerial work platform market that is recovering strongly in the vast majority of regions, but which remains constrained by difficulties in sourcing of components, Haulotte has recorded sales of € 243.2 million in the first half of 2021, up +12% compared to the same period last year.

In Europe, Group sales accelerated sharply in the second quarter, enabling it to post a growth of +9% for the half year compared to the previous year. In Asia-Pacific, half-year sales were down by -18% compared to the first half of 2020. In the strongly growing North American market, the Group's half-year sales were up +39% across all its activities, with sales of aerial work platforms up +48% over the period. In Latin America, despite a still uncertain environment, the Group's business grew by +57% compared with the first half of 2020, driven by almost all markets.

In the first half of the year, equipment sales grew by +9% over the period, rental activity by +29% and finally service activity, which exceeded its 2019 level, has posted a growth of +32%.

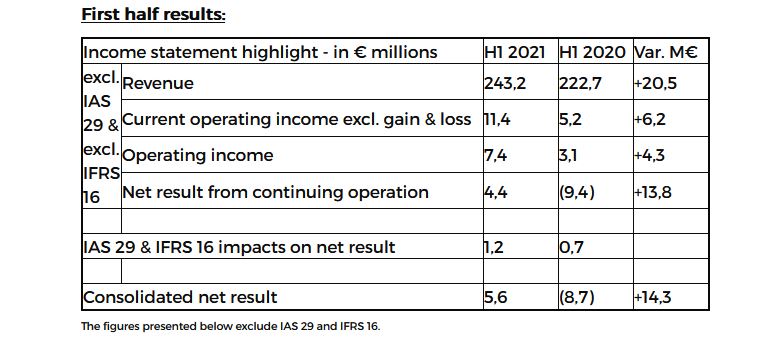

Current operating income (excluding exchange gains and losses) have reached € 11.4 million, or +4.7% of sales, compared with +2.3% in the first half of the previous year. It was driven in particular by growth in all the Group's activities, an increase in component prices, the impact of which was not yet significant in the first half, and good control of fixed costs.

Operating income amounts to € 7.4 million, or 3.0% of revenues, compared with € 3.1 million in the previous year, with an exceptional expense of € (4.2) million booked as at June 30, 2021 explaining the difference to current operating profit. The Group's net income is at € 4.4 million, or +1.8% of revenues, positively impacted in its financial result by the exchange gains (€ 3 million).

The growth in activity and good control of working capital, down by -9 days, have enabled the Group to reduce its net debt (excluding guarantees and IFRS 16) by € -9.9 million to € 123.1 million.

As at June 30, 2021, Haulotte was in compliance with all of its banking covenants and had obtained an additional one-year extension of the syndicated loan agreement from all of its lenders, bringing its maturity to July 17, 2026.

Outlook and recent events:

Driven by sustained sales momentum in the vast majority of markets, Haulotte currently has a historic backlog that confirms its strategic orientations. Penalized by supply difficulties and strong growth in component prices, the impact of which will really be felt in the second half of the year, the Group confirms its forecast of sales growth by more than +15% compared to 2020 and an objective of a current operating margin (excluding foreign exchange gains and losses) between 3% and 4% of sales.

Download the Consolidated financial statements extract

Upcoming event

Quarter 3 sales: October 19, 2021.

Haulotte è lo specialista nella fabbricazione e commercializzazione di piattaforme aeree : piattaforma elettrica, semovente...